Market Watch – July 2024

It is tough trying to read the Byron Bay real estate market. No national consistency exists, and each city, price bracket, and region tracks differently. It is always necessary to drill down into the specific areas and regions, but never more so than now. I will get to the Byron Bay and Northern Rivers market later, but first, let’s look at the national overview.

It’s The Economy, Stupid

Property prices are on the rise in most cities. Brisbane is now the second most expensive city after Sydney, and it has been experiencing consistent growth. Byron Bay usually follows the Sydney trend by six months, but there is no certainty we will follow it this time as there are some contraindications with the local market.

The economy is a hair’s breadth away from a recession, coupled with high interest rates and the continuing threat of inflation. The housing shortage and substantial migration numbers are sustaining the city’s median house price rise. Buyers also realise that the housing shortage is not a passing blip and will take many years, if not decades, to solve. Since the rental market is even more onerous than buying, common sense seems to be, if you can afford to buy, buy now!

A reasonable proportion of sellers and buyers are sitting on their hands, waiting to see what direction inflation and interest rates will go. There is no guarantee that the next move on interest rates will be down. Some are waiting for an indication that spring will be better for selling and that there is a chance there will be a flood of listings. The traditional spring selling bump has not been relevant for some years now. If you are a seller in this market, listing at the correct price to meet the market is essential.

Statistically Speaking

For 16 months in a row, the national market has experienced price growth. There was 0.8% growth in May, the highest since last October. Sydney now has only 1.4% of the previous peak it experienced during COVID-19. Domain and CoreLogic predict a 7-9% price growth in Sydney in 2024. Will this growth and demand translate to the Byron market?

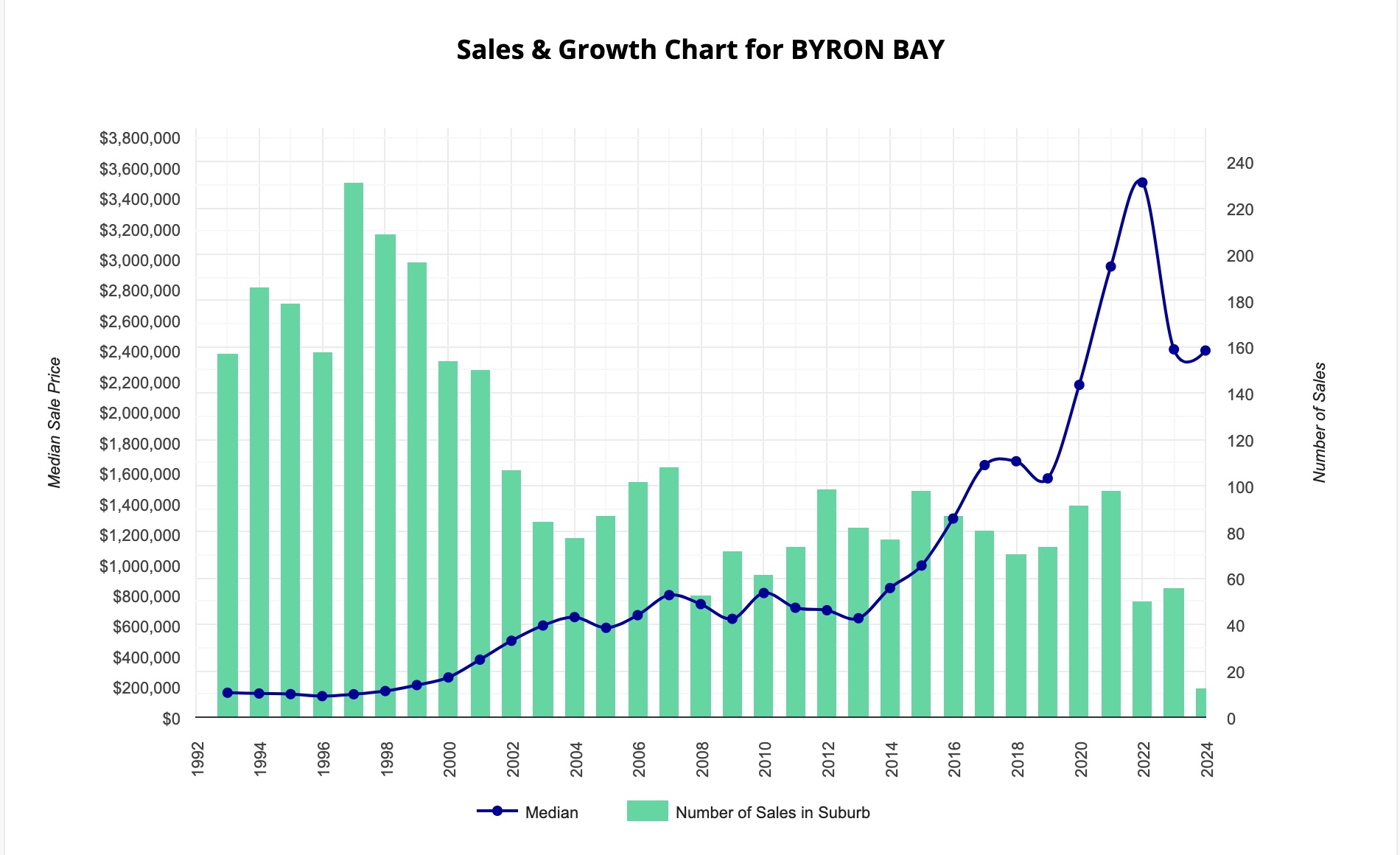

Byron Bay real estate (postcode 2481) is still far from its COVID-19 peaks. If you look at the accompanying graph, the median price is down to $2.4 mil off the high median in 2022 of $3.5 mil – about 30%. Again, Byron is a bit of an outlier to other postcodes in the Northern Rivers, and it is only used as an example.

In the Doldrums

Will the Byron Bay property market return to its COVID peak in six months as Sydney has? My hunch is that it won’t. Even if the median price does get back to that peak, it will only be driven by top-end, high-value properties for the wealthy, as that market is still stronger than the rest. We do not have the migrant surge here that is keeping the floor in the market in the cities.

The median house price in the Northern Rivers will remain weak because, in Mullumbimby, South Golden Beach, Murwillumbah and Lismore, property price drops are baked in as the flood damage equals permanent price damage. Another reason is that Byron and the hinterland suffer from regular episodes of Byron Bashing. Occasionally, the rest of the country chooses to hate us because they think we are up ourselves and believe we are special. That will pass, and they will fall in love with us once again because we are special!!!

Hot Properties - July / August / September 2022

43 Kingsley Street, Byron Bay

view more

Skyfall, 29 Browns Crescent, Mcloed's Shoot

view more

13 Edward Place, Knockrow

view more

Coorabell Ridge

view more

17 Whip Bird Place, Ewingsdale

view more

18 James View Court, Coorabell

view more

The Barbotine, 116-118 Jonson St, Byron Bay

view more

88-90 Mollys Grass Road, Tregeagle

view more

83 Mount Chincogan Drive, Mullumbimby

view more

59 Coopers Shoot Road, Coopers Shoot

view more

Amelika, 28 Blackbean Lane, Federal

view more