Market Watch – May 2023

There has been a lot of speculation on whether the property market has hit bottom. For most of last year, the general market has been in decline with the consensus that there has been an 18-20% drop in the median house price from March 22 – March 23.

Some indicators signal that the market is on an upturn. February national median house price increased by 0.2% and March increased by 0.6%. There also has been a renewed interest coming from investors who are usually first out sniffing for bargains. But the market has not yet moved from FOO (Fear Of Overpaying) to making offers. This link to an article from The Domian is also worth a read.

The top-end, prestige market is still doing well. As you can see by looking at the Hot Property section of this newsletter. The recent record price of $26 mil has now been smashed to $37 mil. Other big sales in the luxury end have also occurred. (More in Hot Property)

Hesitation

There is still a lot of hesitation out there. It will take more than a slight rise to turn it from a buyer’s to a seller’s market. Whatever happens with the RBA announcement today, we are still some distance from a full return to market confidence. And it would seem that rate rises are not over yet.

Rate rises and inflation is not the only things affecting property sentiment. There is also what is known as the Fixed Rate Cliff. This is the possibility that many mortgage holders will be coming off their fixed interest rate loans from April on and faced with higher interest rates. This coupled with inflationary pressures on purchasing ability may force a contingent of homeowners into a forced or distressed sale. This could cause a domino effect of house listings which would flood the market and send prices south. This will also be doubly distressing to those with Negative Equity – where their house is worth less than their mortgage.

There are also the doomsayer prophets. This is a cohort of observers who believe another financial meltdown is in the wings. Their number swells and drops over time, depending on the economic headwinds. I do not believe they are right or wrong but their rising ranks are another cause of more people holding their chips off the table.

Overview

It is a novel feeling to drive around these days and see For Sale signs displayed in front of houses for many, long months. It must be dispiriting for the owners. It is a difficult decision on whether to cut losses and meet the market, or hang on until you find the price you believe in. I have no advice there.

The sentiment is that the RBA will do one more rate rise, probably today, and leave it to plateau for a while. No one expects a full back to normal until interest rates have held steady for a few months. If that is the case, the market in spring will be a lot stronger than it was last year.

Hot Properties - July / August / September 2022

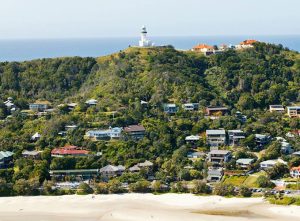

43 Kingsley Street, Byron Bay

view more

Skyfall, 29 Browns Crescent, Mcloed's Shoot

view more

13 Edward Place, Knockrow

view more

Coorabell Ridge

view more

17 Whip Bird Place, Ewingsdale

view more

18 James View Court, Coorabell

view more

The Barbotine, 116-118 Jonson St, Byron Bay

view more

88-90 Mollys Grass Road, Tregeagle

view more

83 Mount Chincogan Drive, Mullumbimby

view more

59 Coopers Shoot Road, Coopers Shoot

view more

Amelika, 28 Blackbean Lane, Federal

view more